Understanding the Labour Pensions Lifetime Allowance

The Labour Pensions Lifetime Allowance (LTA) is a limit on the total amount of money that can be saved in a UK registered pension scheme without incurring a tax charge. The LTA is currently set at £1,073,100 for the 2023/24 tax year. This means that if you have more than £1,073,100 in your pension pot when you reach retirement age, you may have to pay a tax charge on the excess.

The LTA applies to all defined contribution and defined benefit pension schemes registered in the UK. It does not apply to state pensions or personal pensions.

Impact of the LTA on Pension Contributions, Labour pensions lifetime allowance

The LTA can have a significant impact on your pension contributions. If you are approaching the LTA, you may need to reduce your pension contributions to avoid incurring a tax charge. You may also need to consider other ways to save for retirement, such as investing in an Individual Savings Account (ISA).

Impact of the LTA on Pension Benefits

The LTA can also affect your pension benefits. If you have more than £1,073,100 in your pension pot when you retire, you may have to take a smaller pension income to avoid incurring a tax charge. You may also have to pay a tax charge on any lump sum payments you take from your pension.

Potential Tax Implications of Exceeding the LTA

If you exceed the LTA, you will have to pay a tax charge on the excess. The tax charge is 55% for lump sum payments and 25% for income payments.

Maximizing Retirement Savings Within the LTA

The Labour Pensions Lifetime Allowance (LTA) is a limit on the amount of money you can save in your pension schemes without incurring a tax charge. The current LTA is £1,073,100.

There are a number of strategies you can use to maximize your retirement savings within the LTA. One strategy is to make regular contributions to your pension scheme. Another strategy is to take advantage of tax relief on pension contributions. You can also increase your retirement savings by choosing investments that have the potential to grow over time.

Balancing Pension Contributions with Other Retirement Savings Options

In addition to your pension scheme, you may also want to consider other retirement savings options, such as ISAs and investments. ISAs are a tax-efficient way to save for retirement, and you can invest in a wide range of assets, including stocks, bonds, and cash. Investments can also be a good way to grow your retirement savings, but they are not as tax-efficient as ISAs.

When deciding how to allocate your retirement savings, it is important to consider your individual circumstances. If you are close to retirement, you may want to focus on investments that have a lower risk of losing value. If you are younger, you may want to take on more risk in order to potentially achieve higher returns.

Impact of Investment Choices on LTA Utilization

The investment choices you make can also impact your LTA utilization. If you choose investments that have the potential to grow significantly in value, you may reach the LTA sooner. However, if you choose investments that have a lower risk of losing value, you may be able to avoid reaching the LTA altogether.

It is important to seek professional financial advice to help you make the right investment choices for your individual circumstances.

Planning for LTA Exemptions and Protections: Labour Pensions Lifetime Allowance

Understanding the exemptions and protections available can help you plan your retirement savings and minimize the financial impact of exceeding the LTA.

LTA Exemptions

- Primary Protection: Protects the value of your pension savings as of April 5, 2006, up to a maximum of £1.8 million.

- Fixed Protection: Protects a fixed amount of your pension savings, currently £1.25 million.

- Enhanced Protection: Protects a higher amount of your pension savings, up to £1.5 million, if you meet certain criteria.

- Individual Protection: Protects the value of your pension savings as of April 5, 2006, regardless of the amount.

Applying for LTA Protection

To apply for LTA protection, you must complete and submit Form LTA 400 to HMRC before April 6, 2023. You can find the form and guidance on HMRC’s website.

Mitigating the Financial Impact of Exceeding the LTA

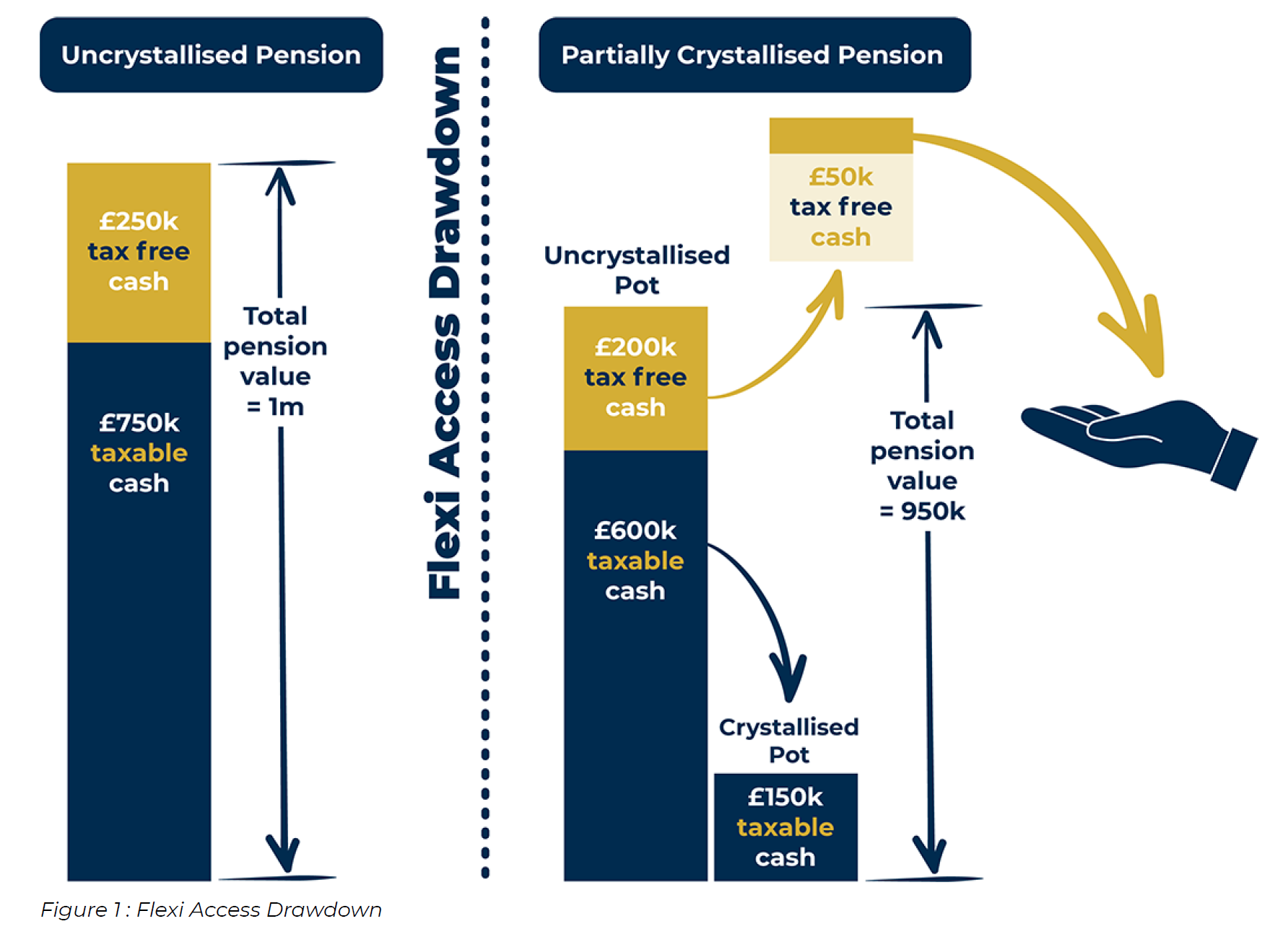

- Drawdown your pension gradually: This can help you avoid exceeding the LTA and reduce the amount of tax you pay.

- Consider using a pension drawdown or annuity: These options can provide you with an income in retirement without exceeding the LTA.

- Seek professional financial advice: A financial adviser can help you plan your retirement savings and minimize the financial impact of exceeding the LTA.